Unlocking Opportunities: The Hidden Perks of a Fresh Legal Credit File

In today's financial landscape, having a strong credit profile is crucial for unlocking a variety of opportunities, from securing a mortgage to obtaining a favorable interest rate on loans. For many individuals, however, a tarnished credit history can create significant barriers, making it challenging to access the credit they need. But what if there was a way to start fresh? A new legal credit file might just be the key to revitalizing your financial future and opening doors you previously thought were closed.

Establishing a new credit file can offer numerous benefits, especially for those who have faced financial hardships or missteps in the past. By focusing on building a new credit profile, individuals can not only improve their credit score over time but also enhance their overall financial credibility. This transition can empower borrowers to take control of their financial journey, paving the way for better loan terms, increased credit limits, and even improved employment prospects. Let's explore the hidden perks associated with obtaining a new legal credit file and how it can transform your financial life.

Understanding a Fresh Legal Credit File

A fresh legal credit file refers to a newly created credit history associated with an individual. This can occur when someone establishes credit for the first time or if they have undergone a legal procedure that results in the clearing of their previous credit history. The significance of a new credit file lies in the potential for individuals to start with a clean slate, unencumbered by past financial difficulties or adverse credit events.

One of the most appealing aspects of a fresh legal credit file is the opportunity for better rates and terms on loans and credit products. Lenders often view a new credit file, especially if it shows timely payments and responsible use of credit, as a chance to build a positive relationship with a borrower. This can lead to enhanced borrowing power, favorable interest rates, and improved chances of credit approval for mortgages, auto loans, and personal credit lines.

Furthermore, a fresh legal credit file can also pave the way for better insurance rates and rental opportunities. Many insurance companies and landlords use credit history as a factor in their decisions. A new credit file that demonstrates a positive payment history can help individuals secure lower premiums and increase their chances of being approved for rental applications, ultimately opening doors that may have previously been closed due to a negative credit history.

Benefits of Starting Anew

Establishing a new legal credit file can be a game changer for individuals looking to improve their financial situation. One of the most significant benefits is the opportunity to build a positive credit history from scratch. This fresh start allows individuals to demonstrate responsible credit behavior without the burden of past mistakes. By consistently making on-time payments and managing credit wisely, they can rapidly enhance their creditworthiness, opening doors to better financial products.

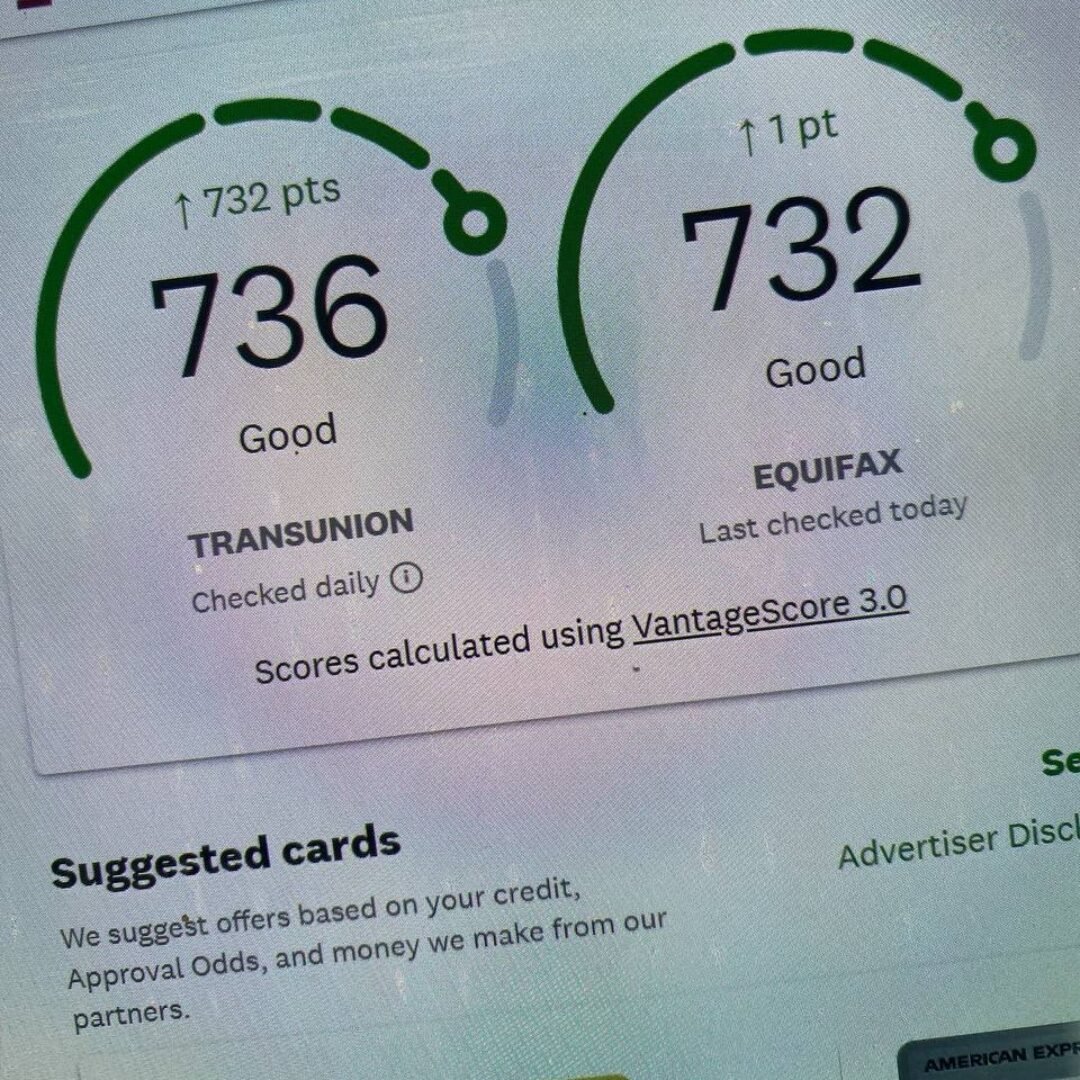

Another advantage of a new credit file is the potential increase in credit scores. Starting anew means that any previously negative impacts on credit scores are no longer a concern. As individuals engage with credit products responsibly, they may see their scores rise, which can lead to lower interest rates and more favorable terms on loans and credit cards. This newfound financial flexibility can empower individuals to make larger purchases or invest in significant opportunities, such as a home or education.

Additionally, a new credit file can provide individuals with a sense of empowerment and control over their financial future. The experience of managing credit wisely and observing tangible improvements in credit scores can boost confidence. This revitalization encourages smart financial habits and decision-making, paving the way for long-term stability and success. Ultimately, the benefits of starting anew with a legal credit file extend beyond just numbers; they lay the foundation for a more secure financial life.

Strategies for Leveraging Your New Credit File

One effective strategy for leveraging your new credit file is to establish a positive payment history. Start by securing small credit accounts that require manageable payments. Always pay your bills on time, as this will reflect positively on your credit report. Timely payments can quickly build your creditworthiness, making it easier to access larger credit sources in the future. Consider using secured credit cards or small personal loans to kickstart your credit journey.

Another important approach is to diversify your credit mix. Venture into different types of credit, such as installment loans and revolving credit, to demonstrate your ability to handle various financial products responsibly. This diversification can enhance your overall credit score, as lenders often favor consumers with a well-rounded credit profile. Just be mindful of not taking on more debt than you can manage, as maintaining a low credit utilization ratio is key to sustaining a healthy credit file.

Lastly, leverage your new credit file by building relationships with lenders and financial institutions. Approach banks or credit unions where you have accounts, and express your desire to establish credit. Often, they have programs specifically designed to help individuals with new credit file s. By demonstrating a proactive attitude, you may unlock additional opportunities, such as better loan terms or higher credit limits, which can further strengthen your financial position.